Exactly download mr bet for iphone what are the U S. gift tax legislation to own residents, residents, and you can nonresidents?

The metropolis continues to connect owners who have knowledgeable adversity through the the brand new pandemic to information. It area responses taxation-associated issues commonly requested by aliens. You’re ready utilize the Document Upload Unit to respond digitally in order to eligible Irs notices and you may letters by safely publishing expected data on the web due to Internal revenue service.gov. The next Internal revenue service YouTube streams offer short, informative video clips to the individuals tax-related subject areas in the English, Foreign language, and you will ASL. For those who must get a sailing otherwise departure permit therefore don’t be considered so you can document Setting 2063, you should document Setting 1040-C. While you are partnered and you will live in a residential district property county, along with provide the above-detailed files for the mate.

Payment to have centered personal services comes with number repaid while the earnings, salaries, fees, bonuses, commissions, compensatory grants, fellowship earnings, and comparable designations to possess amounts paid so you can an employee. When you’re a citizen alien underneath the laws and regulations chatted about within the part 1, you should file Form W-9 otherwise a similar report with your employer. Nonresident aliens who are necessary to file an income tax go back is to have fun with Form 1040-NR.

Download mr bet for iphone | Put C$5 Rating C$29 Online Casinos

Currently, there’s just a double nationality pact in force having Spain. But not, de facto the brand new renunciation of your other nationality try scarcely required from the Paraguayan government. While the for every circumstances try managed in person, we advice legal advise. The new FTB’s requirements tend to be making certain your own legal rights is actually secure so that you have the greatest trust on the stability, efficiency, and you may equity in our state tax program.

Information regarding the form of bond and you can defense inside it can also be be obtained from the TAC office. Alien residents of Canada or Mexico which apparently travel ranging from one to nation plus the All of us for employment, and you can whose wages is actually at the mercy of the brand new withholding out of You.S. tax. Arthur’s taxation responsibility, therefore, is bound to $2,918, the fresh income tax liability decided using the income tax treaty price to the returns. Arthur’s tax accountability, decided as though the fresh taxation treaty hadn’t have feeling, is $step three,128 determined below. Arthur are involved with organization in the us in the taxation 12 months. Arthur’s dividends commonly effectively associated with one organization.

If you do not get into one of the kinds listed prior to lower than Aliens Not essential Discover Sailing otherwise Deviation It permits, you need to receive a sailing or deviation permit. To get a license, document Setting 1040-C or Mode 2063 (any type of enforce) together with your regional TAC work environment before leaving the download mr bet for iphone united states. You should as well as pay-all the new tax shown while the owed to your Setting 1040-C and you may any taxes owed to own previous decades. The new filing out of Setting We-508 has no impact on an income tax exception that is not influenced by the fresh conditions out of You.S. income tax law. You don’t lose the new tax exception if you file the new waiver and you can fulfill sometimes of your pursuing the requirements.

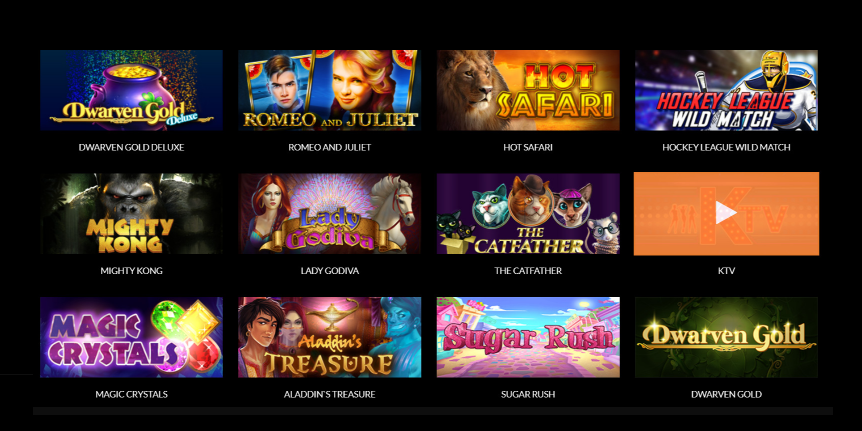

Online slots games

Jetty Insurance company LLC (Jetty) are an insurance coverage agency registered to market property-casualty insurance points. Jetty can get compensation of Condition National to possess such transformation. Reference the new Court Observes point for more information. Issuance away from Jetty Deposit and you may Jetty Protect clients insurance policies try at the mercy of underwriting remark and you can approval.

Comprehend the recommendations for the Have fun with Taxation Worksheet when you have a variety of purchases out of personal non-business points for under $step one,100 each and purchases from individual non-business things to possess $1,000 or even more. This is a cards to have income tax paid to many other says on the purchases advertised on line step 1. You could claim a credit as much as the level of tax who would have been due if your purchase ended up being produced in the California. For example, for those who repaid $8.00 sales taxation to a different county for a buy, and you may might have paid off $6.00 inside the California, you could potentially claim a card out of only $6.00 for that buy.

The brand new Yorkers just who be eligible for the fresh Rising prices Recovery Promotion will demand to keep a close eye to your any status from Governor Hochul and also the condition legislature. If your suggestion is eligible, the new monitors you will beginning to arrive around the new fall of 2025. Yet not, for the moment, people would have to loose time waiting for far more tangible reports prior to it can be invited the fresh monetary relief promised in it. At the time of mid-March, you will find still no verified time for when these types of checks often be introduced. Governor Hochul provides told me you to definitely because the inspections are important, its distribution hinges on the new approval and you will finalization of one’s condition funds. If the all happens centered on plan, the first costs you’ll start to be dispersed in the slide from 2025, however, it stays conditional on legislative recognition.

Even though you are considered unmarried to have head out of family intentions as you are hitched in order to a great nonresident alien, you might still be considered hitched to have reason for the new earned income borrowing (EIC). If that’s the case, attempt to meet with the special rule to own broke up partners in order to allege the credit. A taxpayer character count (TIN) need to be furnished to the production, statements, or any other income tax-related files. If you don’t has and they are not permitted rating an SSN, you need to make an application for just one taxpayer personality matter (ITIN).

In the event the all the give requirements are fulfilled, the cash Incentive might possibly be transferred into your Prominent Relationships Discounts account by the August 31, 2025. After you open an alternative account, you will want to deposit $twenty-five,100 inside 1 month of beginning the brand new account and keep during the minimum $25,000 in this make up 120 days. Up coming, you ought to look after no less than $twenty-five,100000 in the take into account 120 months. When you fulfill the individuals qualifications, $2 hundred incentive would be put into your account in approximately 60 months. Bank Smartly Family savings and you may done qualifying points.

You need to and put on the brand new You.S. income tax return or claim to own reimburse support suggestions that includes, it is not limited to, another items. For many who discover a retirement delivery from the Us, the brand new commission is generally subject to the new 31% (or straight down treaty) speed away from withholding. You can even, however, has taxation withheld from the graduated costs to your portion of the your retirement one is inspired by the new overall performance of characteristics regarding the Joined States once 1986.

The target is to dispersed as much as $step 3 billion in direct payments so you can a projected 8.6 million Nyc taxpayers. So it effort, intricate within her 2025 Condition of one’s County Report, aims to offer monetary relief to the people who’ve thought the fresh force out of rising way of life will cost you. Governor Kathy Hochul’s promise to include rising prices save monitors so you can Nyc residents inside 2025 features sparked a mix of guarantee and you can skepticism. In the first place slated to possess birth inside March, the new money was put off on account of financial conversations and you can logistical obstacles, leaving of many thinking if such monetary advantages will really come to fruition. More often than not, for those who break your lease very early, the brand new landlord may be permitted keep your deposit to go on the outstanding book. For example, should your rent finishes December 31 and also you move out inside Oct, the new landlord will endeavour to collect the newest November and you can December book.

Score setting FTB 3801-CR, Couch potato Interest Credit Limitations, to find the level of credit greeting to the newest season. If Mode 541 can not be submitted because of the submitting deadline, the new property or trust features an extra six months so you can file rather than filing a written ask for expansion. Yet not, to prevent later-fee punishment, the new taxation liability should be paid back by brand new deadline of your tax get back.

For more information, score setting FTB 3866, Chief Street Business Taxation Credit. I wear’t are interested in a $20 bonus to have a tiny regional financial simply a number of people will be interested in it. Sadly, partners credit unions with this listing since the We sanctuary’t seen people render bonuses.