Depositing an excellent cheque Twerk slot together with your mobile device

View the deposit steps Twerk slot self-help guide to find their popular choice. I find mobile charging you casinos you to fees virtually no costs when placing funds on the cell phone. You can read much more about any additional charge to your casino’s percentage webpage.

Twerk slot: What direction to go which have a just after cellular deposit

Such as a charge card, the telephone seller is also demand investing limitations according to the using designs. You will need a postpaid connection, the spot where the cellular phone supplier often expenses your monthly. The fresh gambling establishment deposit created by cellular telephone might possibly be among them costs. The procedure works similarly to a charge card for the reason that you discover dollars now and you can pay it off after the new week. As well as which have a cap on the restriction places, you won’t have the ability to cash out by using the shell out by the mobile phone strategy.

Put currency using QR Cardless

- However, fundamentally, they rewards you with kind of casino borrowing from the bank to utilize on the game.

- Atm put concerns placing a in person at the one of the financial’s ATMs.

- Bring an image of one’s cheque and you can fill in they due to your application, for the matter and you can payee info.

- Before you start, disconnect the newest consider out of people stub or other paper.

The newest Barclays application Tips pay in the an excellent cheque It’s easy to expend inside a good cheque on the Barclays app. Place the cheque for the a plain records one to’s darker versus cheque. Ensure that the whole cheque is visible inside the corners out of the fresh physique. Hold their device constant as well as the app have a tendency to automatically capture a images of the cheque.

What the results are if i remove my personal mobile connection while you are I am investing inside the a cheque?

As mentioned above, just because your deposit a via your lender’s mobile app doesn’t suggest you can put from consider. Even when your own mobile deposit appears to come off instead of a great hitch, it does be a good idea to retain the fresh papers view after they clears, and in case here’s an issue after. Should your financial plans to set a hang on the brand new put, you may also found an alerts ahead of signing a mobile take a look at deposit. You’d up coming have the choice to continue on the mobile put and take the fresh look at so you can a branch as an alternative. Check with your lender observe the policy for holding dumps as well as how easily their cellular consider dumps would be to clear. An out in-person deposit for the bank teller allows you to immediately accessibility the newly deposited financing.

Cellular cheque put is actually a mobile banking device which allows you in order to deposit cheques on the savings account using your smart phone. All the dumps which can be shipped otherwise produced at the merchandising cities are usually canned another working day immediately after he’s gotten. Zelle is intended to own money to help you users you realize and faith and you may isn’t designed for the acquisition of goods out of retailers, online markets or as a result of social media postings. Neither Zelle nor Pursue provide defense if one makes a purchase of items using Zelle and do not found her or him or receive them damaged or much less described otherwise requested. In case there is mistakes or questions regarding your own digital fund transmits, and details about compensation to possess deceptive Zelle repayments, see your membership contract. That it compensation program is not required by law and could end up being modified or left behind when.

To learn more about steps to make a funds deposit in order to a ConnectNetwork account at your local retail store, please visit our very own FAQ web page. Discover a savings account reveals inside the another window otherwise discover a certificate from Put (discover rates Opens up inside a different windows) and start rescuing your finances. Personal lines of credit is actually fund and therefore are dependent on approval away from borrowing. Ahead of Due to Spend or an enthusiastic Overdraft Line of credit are utilized, their checking account harmony will be used to security your own overdraft.

Save time and money

If the on the internet bank features an electronic check element, you might snap an image and publish the bucks acquisition to your bank account for put. Should your financial doesn’t get this function, you could post they to your lender’s head office for deposit. Get the savings account Opens in the a new window that is greatest for your requirements. See the Chase Complete Examining Reveals within the a different screen offer for new checking consumers. Listed below are some the family savings as opposed to overdraft charge Opens inside the a good the newest window.

- Financial institutions features financing access principles you to definitely determine how long it needs to own a check to clear.

- Discover a confirmation so that you know straight away their deposit has already been gotten.

- Here are a lot more strategies for and then make cellular take a look at dumps.

- Touch base by visiting our very own Contact form otherwise plan an appointment now.

There are many fantastic benefits away from gambling via that it put approach which have been attracting a little more about professionals for the alternative. Right here we’ll make you a sense of a number of the biggest benefits for the gaming means, each one of you’ll feel when betting to your cell phone statement sports books offered right here. Bettors must always understand that there are numerous charge to own cellular telephone expenses gambling and this are very different heavily out of services to help you provider. Specific internet sites have a tendency to charge for in initial deposit and an excellent withdrawal, meaning that if you are spending through mobile phone bill is fantastic for delaying their bet, it could be slightly costly. These may come with charge, so make sure you look at this type of before deciding exactly how much you put to your membership.

In case your cheque bounces while the individual that composed they doesn’t are able to afford in their membership to pay for it, their mobile deposit was stopped. You’ve got fast access to help you fund transferred into the account out of other Bank from America deposit account. Considering Financial away from The united states’s Put Agreement and you will Disclosure, there can be instances in which fund availableness try put off. The original $225 of your transferred financing will be available to choose from the newest second business day, however. If you feel you may have be a prey of a good mobile deposit fraud, get hold of your local police agency instantaneously and you may alert debt establishment immediately.

For example, pay-as-you-wade users notice the commission has been removed of its mobile equilibrium. From the OP’s situation, the new sender of the consider is one studying the new look at instead of the individual, that is the simply change from the “normal” practice to possess digital inspections. As the view clears (I have seen months as the an optional holding several months) it’s okay to help you damage the initial. A june 2009 questionnaire by Independent Neighborhood Bankers away from The usa learned that 62% from banking companies in the united states offered seller remote put, and 78% had intends to follow the technology by 2011. Realize your account agreement cautiously and check together with your lender. And connected banking companies, People FDIC and you may wholly possessed subsidiaries from Bank away from The usa Firm.

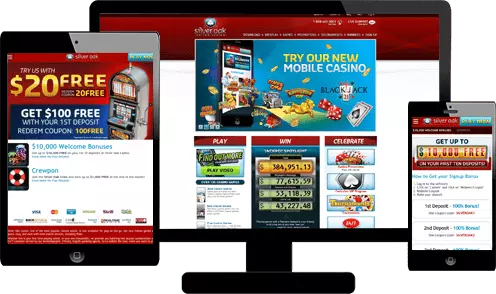

You will see all in all, all cheques transferred on the membership information. They have been found as the an excellent pending exchange first, until the finance are designed readily available. Paying because of the mobile phone is an effectual form of online casino deals.